Managing personal finance in 2025 has transformed from a complicated, manual process into a seamless and intelligent experience. With AI-powered analytics, real-time investment insights, and adaptive budgeting tools, individuals now have the ability to track, save, and grow their wealth more efficiently than ever before. Here are five financial apps leading the revolution this year.

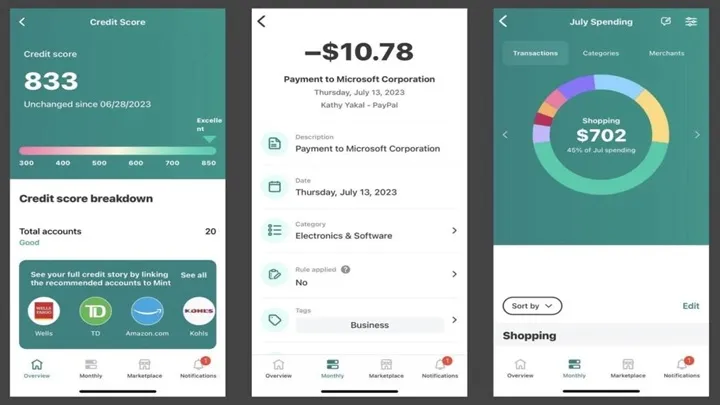

1. Mint Pro 2025

Mint, a long-time favorite for personal budgeting, has upgraded in 2025 to include advanced AI-driven spending analysis and predictive budgeting. Users receive real-time insights into their financial habits, personalized savings plans, and proactive fraud detection alerts.

Why it stands out: Mint Pro 2025 links directly to bank accounts, credit cards, and investment portfolios, giving a full picture of one’s finances in one dashboard. Automatic bill reminders and adaptive spending suggestions help reduce late fees and boost savings over time.

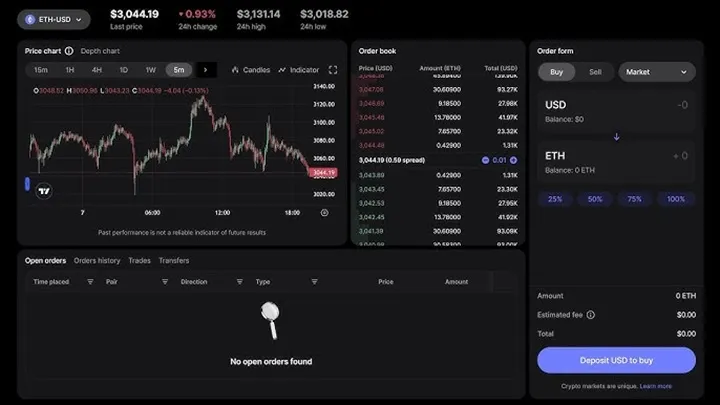

2. Revolut X

Revolut has become a global financial ecosystem. The 2025 version supports multi-currency wallets, instant cross-border payments with minimal fees, and AI-powered investment tools for stocks, crypto, and ETFs.

Who benefits most: Digital nomads, freelancers, and international business owners who want fast, low-cost transactions while also managing investments from one platform.

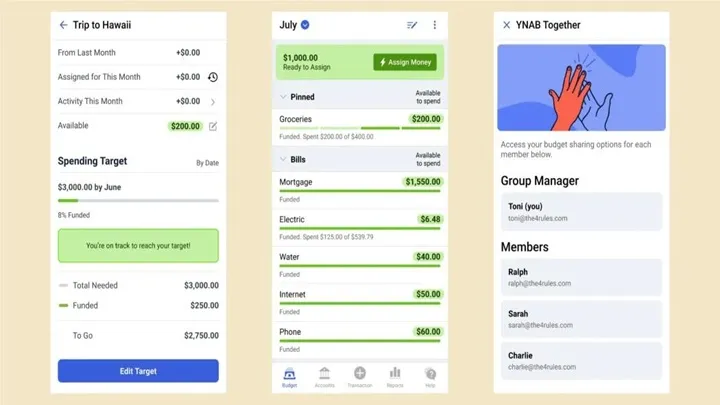

3. YNAB AI (You Need A Budget)

YNAB continues its mission of teaching financial discipline, now enhanced with machine learning. The app adjusts your budgets dynamically based on your income flow and spending behavior.

Key advantage: Helps users finally break free from living paycheck-to-paycheck by predicting future expenses and suggesting proactive adjustments.

4. Robinhood Next

Robinhood revolutionized stock trading years ago, and in 2025 it goes further with AI-powered portfolio optimization and micro-investment features. Beginners can invest small amounts while accessing risk-adjusted recommendations.

Highlight: Instant trade insights, smart notifications for market shifts, and educational tools integrated for first-time investors.

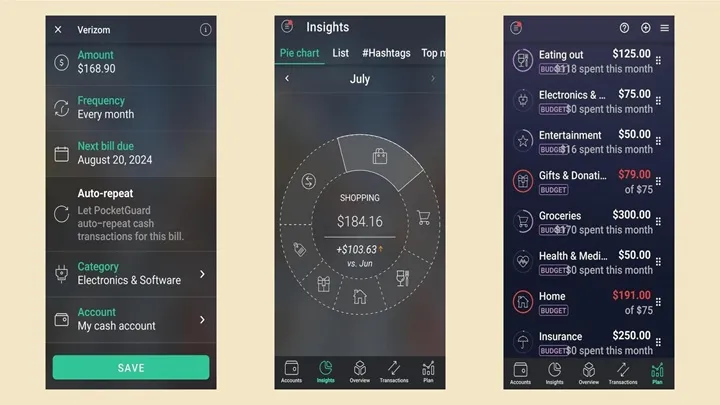

5. PocketGuard Plus

PocketGuard helps users manage every dollar effectively with advanced security, automated expense categorization, and predictive cash flow analysis.

Why it’s popular: The app is perfect for people prone to overspending—it provides real-time alerts when you’re about to exceed your budget.

Why These Apps Matter in 2025

As inflation, unpredictable markets, and digital payment ecosystems evolve, having a smart financial assistant is no longer optional. These apps give everyday users access to tools once reserved for financial advisors—making it easier to save, invest, and plan for the future.

Conclusion

From tracking expenses to investing in global markets, these finance and money management apps are redefining personal wealth strategies in 2025. If you want to stay ahead financially, these tools deserve a place on your smartphone.